Tampa Unpaid Overtime Lawyer

It is against federal law for an employer to refuse to pay overtime wages. The U.S. government has statutes that guarantee overtime pay – or one and a half times the regular rate – for employees who work more than 40 hours in one week. If your employer is failing to pay you overtime when you qualify for it, you have the right to act.

Florin Gray can help Tampa employees take a stand against employers who refuse to obey overtime laws. Our Tampa unpaid overtime lawyers are selective with the cases we take, so our clients can benefit from one-on-one attention from an attorney. Our experience representing employers and employees gives us a unique perspective. As our past clients can attest, we take cases other firms reject. Trust us with your unpaid overtime cases for your best chance of success. Contact us today for a free legal consultation.

What Is Unpaid Overtime in Tampa?

Despite employers making more than enough to pay workers fair wages, they often unlawfully short-change employees who work overtime. This can happen accidentally, with accounting errors or employers who don’t keep proper track of hours. More likely, however, employers intentionally engage in unpaid overtime to make a better profit margin. Either way, as the employee who isn’t earning what you should be, you have rights.

Unpaid overtime often comes in the form of employers asking employees to clock out but to continue working. In other cases, employers don’t pay workers for training or force them to come in early to prepare for work without paying for this time. Forcing an employee to work through lunch or work without breaks is also an example of unpaid overtime, as is requiring an employee to work more than 40 hours (without overtime) to make up for missed hours from another week.

As the victim of unpaid overtime in Florida, you may be missing out on hundreds or thousands of dollars your employer rightfully owes you. Whether your employer doesn’t count working from home, says that part of the job is “volunteer work,” or tries other ways to trick employees into missing out on federally mandated overtime pay, you have rights. Explore your legal options in the face of an unpaid overtime scheme with help from the attorneys of Florin Gray.

How Much Can You Win in an Unpaid Overtime Case?

Filing a lawsuit against the company is one of the possible actions you can take against your employer for unpaid overtime. The Florida civil courts will hear cases involving an underpaid or unpaid employee if you have the elements of a claim. You must show that you qualify for overtime (that you aren’t an exempt employee), that your employer has violated an overtime law, and that you suffered damage as a result. If you win your case, the courts may award you the following damages:

-

Unpaid wages. You can fight for the time-and-a-half wages you should have received from the hours you worked overtime. You will base this amount on records that show your overtime hours worked. Subtract what your employer paid you from what you should have received at 150% your regular rate. Note: you’re eligible to receive at least 150% of Florida’s minimum wage ($14.00), not the federal minimum wage ($7.25).

-

In many unpaid overtime cases, the courts will award employees interest on top of their missing unpaid wages. Interest serves to punish the employer for failing to give you the amount he or she lawfully owed you. Interest payments aim to make up for the time you had to go without the wages you rightfully earned.

-

Penalties (liquidated damages). Federal law gives employees the right to also seek penalty pay in addition to lost wages and interest. If you win your lawsuit, the courts may assign penalties as an additional payment to you, because your employer broke the law. These damages will match your unpaid wage award. To claim these damages, you must notify your employer in writing of your intent to file a lawsuit and your employer must fail to act.

-

Attorney and court fees. In addition to recovering the costs of all your wage-related damages, interest, and penalties, the courts could also award you compensation to pay for your attorney’s fees and court costs. Since you would not have had to pay these costs were it not for your employer’s wrongdoing, you can seek to recover these damages in your lawsuit.

Talk to our attorneys to find out the value of your case. The results of your case will depend on how much overtime your employer has failed to give you, how long your employer has been misclassifying you, and how extensively the error has affected your life and family. A great attorney can help you maximize your recovery through a smart, aggressive legal strategy. Trust Florin Gray with your unpaid overtime case for the best possible results.

What Is the FLSA?

The federal Fair Labor Standards Act, or FLSA, is a major component of unpaid overtime claims. The FLSA is the federal law that mandates overtime pay for all employees who work more than 40 hours in a single week. The FLSA states that covered employers must legally pay qualified employees 150% of their regular hourly wage for each hour over 40 per week. The FLSA applies to the majority of employees; however, there are exemptions:

- Certain commissioned employees (salespeople)

- Railroad and air carrier employees

- Taxi drivers

- Certain broadcasting station employees

- Executive, administrative, and professional employees (white-collar workers)

- Employees of certain seasonal recreational businesses

- Certain small newspaper and delivery employees

- Seamen who work on foreign vessels

- Employees of fishing operations

- Certain farm workers

- Casual babysitters

- Casual people employed to caretake for the elderly or disabled

- Domestic service employees who live at work

- Movie theater employees

Note that FLSA overtime pay exemptions are very narrow. The odds are high that your employer legally owes you time-and-a-half pay for overtime hours you work. Don’t assume you’re exempt if your employer refuses to pay you overtime. Investigate the situation yourself to see if the act technically includes you. Keep in mind that the type of work you do, not your classification as an employee or independent contractor, determines whether you are exempt or nonexempt.

FLSA Regulations Against Unpaid Wages

Under the FLSA, it is illegal not to pay eligible employees’ overtime if you’re a covered employer in the United States. Covered employers must pay nonexempt employees full minimum wage and statutory overtime for the workweek in question. Failing to pay these amounts is a violation of the FLSA that could land the employer in significant legal trouble. If you believe your employer has violated the provisions of the FLSA, protect your rights and contact an experienced unpaid overtime attorney in Tampa.

Various statutes in the FLSA order back pay, or the difference between what the employee receives and what he/she should have received, for employees who don’t receive adequate wages. The FLSA provides a means for employees to recover unpaid wages through the Wage and Hour Division, a lawsuit from the secretary of labor (who may file a lawsuit for back pay), a private lawsuit, and/or an injunction. A lawyer can help you explore all your options for financial recovery in Florida.

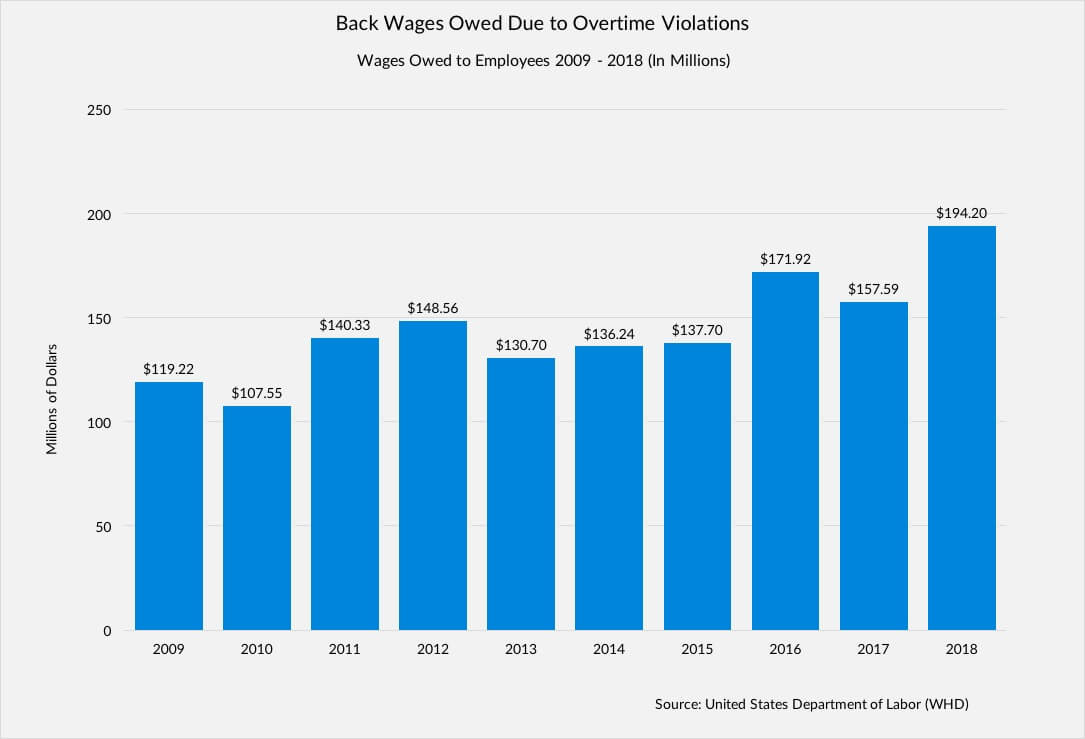

In 2018, the United States Department of Labor, Wage and Hour Division found nearly $200 million in back wages owed to employees due to overtime violations, the most in recent memory and almost $40 million more than 2017.

What to Do If Your Employer Hasn’t Paid Your Overtime

The moment you suspect your employer isn’t paying the overtime wages you believe the law entitles you to, act to protect your rights. Allies are available to help you talk to your employer, understand your options, and take legal action in pursuit of wages that are legally yours. If you aren’t sure what to do, contact our firm for advice. We can give you tailored solutions based on your situation. In the meantime, here are a few general steps we recommend you take:

-

Talk to your employer. There’s a chance your employer simply doesn’t know the federal rule or doesn’t realize he or she isn’t paying you overtime. Explain why he or she owes you overtime pay based on the law and the number of hours you’ve worked. Use time clocks or other evidence to prove your case. Your employer may listen and remedy the situation.

-

File a complaint with the Department of Labor. Unlike many other states, Florida doesn’t dedicate a state agency for employee complaints. No state agency enforces state wage and hour laws specifically. Instead, you will bring your unpaid overtime complaint to federal authorities at the Department of Labor. Follow the directions for filing a complaint. The investigative process will ensue.

-

File an unpaid wage lawsuit. You may be able to hold your employer accountable for misconduct through a civil lawsuit. Our lawyers can help you file a lawsuit against your employer in pursuit of economic damages, penalties, and non-economic damages. We can gather evidence, investigate your employer, and take care of the legal processes on the road to recovery.

Feel free to contact Florin Gray at any stage in the legal process. Whether you’re still unsure if your employer owes you unpaid overtime wages or you’ve already tried and failed to get the wages you’re owed through a Department of Labor complaint, we can help. Our unpaid overtime attorneys will immediately step in, take over your case, and gear your claim toward top results. We’ve helped dozens of employees in Tampa, Florida get the wages the law entitles them to have.

It’s Your Duties that Determine Your Classification in Florida: Not Your Title

It is important to note here that an employer cannot simply change a person’s title in order to exempt that person from overtime requirements. Your employer can call you an administrator from here to eternity, but if you spend your entire day filing papers and serving your boss coffee, you are not exempt. This exemption depends on your duties and on your exercise of autonomy in making decisions. To be exempt as an administrator you must have the authority to make independent decisions that affect the operations of the business without immediate supervision or direction of a superior.

Below are some (but not all) of the duties that define an administrator, according to the FSLA:

- You have the authority to formulate, affect, interpret, or implement management policies or operating practices;

- You carry out major assignments as a part of the conducting of the business operations

- You perform work that affects business operations to a substantial degree;

- You have the authority to commit the employer in matters of significant financial impact;

- You have the authority to waive or deviate from established policies and procedures without prior approval.

Independent Contractors Overtime Coverage

True independent contractors are not entitled to overtime. That said, it is a common scheme that some businesses employ to declare some or all of their workers to be independent contractors when they are actually nothing other than employees. They issue them a 1099, don’t pay their Social Security contribution or other payroll taxes, and don’t pay them overtime. If any of the following does not apply to you, you do not qualify as an independent contractor, regardless of that 1099:

- You are a self-employed and own your own business.

- Your contract your services out to other businesses as well as the one in question.

- You determine your own hours.

- You use your own equipment.

- You are free to hire others to assist in the performance of your work.

- You determine when payment is due and how much (the rate being agreed to by contract)

- You determine how you spend your time on the job, not a company official. For example, no one can tell you to cover the phones while others are out to lunch or in a meeting.

- You are paid for a completed project or service, not for the number of hours you are present at the business.

- You do not punch a time clock.

If you go to the same job during the same hours every day, do what a supervisor or business owner tells you to, and take instruction on what to do and/or how to do it from a supervisor, then you are not an independent contractor and you are entitled to overtime pay (and certain other benefits, including possibly a refund on your taxes from the employer). This is true even if you signed an independent contractor agreement.

Other Nefarious Tactics: Comp Time, Averaging, and Working Off the Clock

Beware of these tactics that employers often try to get away with to deny you your overtime pay:

-

Your employer may ask you to work extra hours and agree to give you the same number of hours as paid time off. Paid at your regular rate, that is. This is a common scheme to avoid paying required overtime.

-

Your employer keeps you working through lunch time and breaks or other periods of time off the clock, without paying you extra.

-

Having you work over 40 hours one week and less the following week, then averaging the two and giving you straight pay. You are entitled to overtime for any week that you work more than forty hours. Period. No averaging is allowed to deprive you of overtime pay.

Contact Us Today for a Free Unpaid Overtime Consultation

You must act fast for your best odds of securing compensation for unpaid overtime wages in Florida. You must adhere to time limits, or the courts will refuse to hear your case. Don’t let a negligent or selfish employer get away with paying you less than you deserve. Contact our Tampa unpaid overtime attorneys today to schedule a free unpaid overtime case evaluation.